Cameroon’s Hidden Economic Giants: The Paradox of High Revenue, Low Compliance, and Informal Employment

Project Information

Project Details

This article is the result of a data analysis conducted as part of the UCF Volunteer Challenge – July 2025 Edition, an event that encourages volunteers to transform raw data into powerful insights. The data used for this analysis was carefully sampled by the Utafiti Research Team from a public dataset provided by Cameroon Business Census (2020). The sampling was performed by NDAYAMBAJE Alexis of the Utafiti Corporation team. The data analysis and article writing were conducted by DJUIKAM Eunice, a participant in the challenge.

Cameroon’s Hidden Economic Giants: The Paradox of High Revenue, Low Compliance, and Informal Employment

Introduction

Cameroon’s business ecosystem is a tapestry of resilience, creativity, and entrepreneurial spirit. Yet behind this vibrant facade lies a complex paradox: businesses earning substantial revenues and employing large workforces are operating informally and avoiding tax compliance.

This trend challenges conventional assumptions that informality is a survival strategy reserved for micro and small businesses. Instead, it points to a deeper structural issue in the economy — one that has major implications for fiscal policy, social protections, and market dynamics.

This article explores what the data says, why it matters for policy and economic development, and what it means for policymakers aiming to foster inclusive growth.

What is the data ?

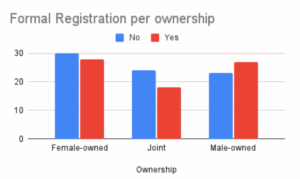

- More businesses operate in the informal sector (77 in the not formally registered vs 73 formally registered.)

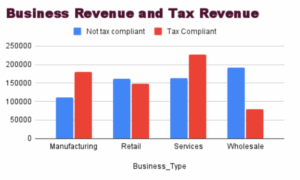

- There are less tax compliant businesses than those that are not complaint (76 non compliance vs 74 tax compliance)

- There are more than 70 businesses that have more than 40 employees and have a monthly revenue above 5000USD,.

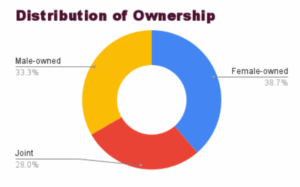

- More businesses are female-owned. Out of 150 businesses, 58 are female owned against 50 male owned and 42 jointly owned.

❖ What the data says

A review of the 2020 dataset reveals striking patterns:

❖ High-revenue, low-compliance businesses: Businesses with monthly revenues exceeding $10,000 remain unregistered or are not tax compliant.

➢ Example: A female-owned retail business in Littoral earns $14,585 per month with 76 employees and is not formally registered.

➢ Example: A male-owned retail business in North West generates $12,868 with 85 employees, yet is non-compliant.

❖ Significant employment in informal businesses: Many informal businesses in this dataset exceed 50 employees, contradicting the image of informality as a small-scale survival mechanism.

❖ Ownership patterns: Female-owned businesses feature prominently among high-revenue informal businesses, highlighting potential systemic barriers to formalization while joint-owned businesses show mixed compliance, suggesting governance and decision-making challenges.

Sector dynamics:

❖ Retail and wholesale sectors are dominant among these high-revenue informal businesses.

❖ Manufacturing and agriculture sectors also appear but with slightly higher registration rates, especially among male-owned enterprises.

Why this matters for policymakers

1️. Untapped tax revenue potential

High-revenue informal businesses represent a large, yet mostly ignored, tax base. Strengthening compliance here could yield significant fiscal resources to finance infrastructure, health, and education — without increasing rates or broadening the burden on compliant micro or small businesses.

These high-revenue businesses represent a substantial untapped tax base. Targeting them could increase government revenue without burdening smaller micro-businesses or the broader informal sector.

- Social protection and labor policy gaps

Large numbers of employees in informal high-revenue firms are not covered by social security or labor protections. This perpetuates a vulnerable working class, at odds with Cameroon’s development goals and SDG commitments. This leaves many workers without safety nets, exacerbating poverty and vulnerability.

Formalisation and improved compliance can dramatically expand coverage and create safer, more stable employment.

- Inequitable market environment

Informal high-revenue businesses create an uneven playing field, allowing them to undercut compliant firms. This discourages formalization by smaller actors and erodes trust in public systems. Policies that tackle this segment can reinforce fair competition and improve overall business ecosystem health.

- Inadequate policy targeting

Many formalization policies focus narrowly on small or micro businesses. The presence of these “hidden giants” suggests the need for differentiated approaches that address high-revenue informality,

Policy implications by business type

- Retail and Wholesale

❖ Characteristics: High cash turnover, large networks of informal suppliers, easy price undercutting.

❖ Policy actions:

➢ Introduce simplified tax regimes or flat-rate schemes based on turnover thresholds to encourage entry into the tax net.

➢ Create targeted audit and compliance programs focusing on high-volume outlets, using digital payment data and inventory records.

➢ Strengthen supply chain monitoring, requiring formal status for certain large-scale retail contracts.

- Manufacturing

❖ Characteristics: Tends to require machinery, fixed locations, and often engages in larger volume contracts.

❖ Policy actions:

➢ Link access to industrial zones, electricity subsidies, or import duty reductions to formal registration and tax compliance.

➢ Establish dedicated compliance facilitation offices within industrial clusters to support smoother transition into formal status.

➢ Offer targeted incentives for firms integrating local content or exporting, conditional on full compliance.

- Services

❖ Characteristics: Diverse, often fragmented, ranging from professional services to logistics and hospitality.

❖ Policy actions:

➢ Introduce sector-specific compliance programs, focusing first on large service providers (e.g., logistics hubs, big hospitality operators).

➢ Require proof of compliance for access to certain licenses (e.g., tourism certifications, professional practice authorizations).

➢ Collaborate with professional associations to promote formalization as a reputation and quality marker.

Additional policy considerations

- Gender-sensitive interventions

Female-owned high-revenue informal businesses suggest deeper systemic barriers: administrative complexity, discriminatory practices, or limited access to legal and financial services. Policymakers could:

- Establish women-focused business support desks at regional tax offices. ● Offer legal aid services and simplified tax training specifically for women entrepreneurs.

- Design communication campaigns showcasing successful female-led formal businesses as role models.

Agriculture

This is traditionally seen as low-margin, rural, and difficult to monitor; however, large agro-enterprises exist (more than 20 businesses with more than 200,000 USD cumulative monthly income)

- Policy actions:

○ Promote cooperative formalization: group small producers into cooperatives, simplifying compliance and tax reporting.

○ Provide tax incentives for value-added agricultural processing to encourage formal supply chain development.

○ Strengthen agricultural extension programs to include training on business formalization and tax benefits.

Conclusion

Cameroon’s high-revenue informal businesses are powerful economic actors generating substantial income and employment but operating outside formal systems. By designing

sector-specific, gender-sensitive, and regionally tailored policies, policymakers can unlock new tax revenue, extend social protections to vulnerable workers, and strengthen fair competition.

Formalising these businesses is not just about compliance, it’s about creating a fairer, more inclusive, and more resilient economic foundation for Cameroon’s future.

DJUIKAM Eunice, all rights reserved 2025